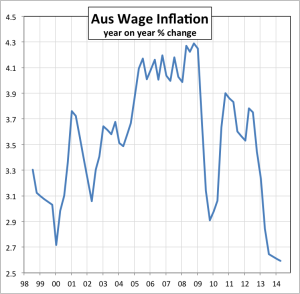

Consistent with a soggy economy and deteriorating labour markets, Australian wage increases continue to slow. In the June quarter, the year-on-year percentage increase was 2.6%, just matching the year-on-year change in the March quarter.

Wage inflation is now lower than it was during the GFC (2008/9) and lower than in the 2000/01 recession, and has been for over a year. And there is little chance of it reaccelerating, short term.

Wage inflation is now lower than it was during the GFC (2008/9) and lower than in the 2000/01 recession, and has been for over a year. And there is little chance of it reaccelerating, short term.

This augurs ill for growth. In last week’s SIRA Views, we discussed the slowdown in mining capex, and how this will be a strong headwind for our economy. A few weeks ago, we discussed the need for “confidence”. Although consumer confidence has improved a little, it is still far from robust. Yet the economy needs other sectors to take up the slack caused by the likely slump in mining investment. And it doesn’t look as if it will be consumer spending which fills that hole, because wage increases are below the inflation rate, unemployment is drifting up and the political rhetoric is negative.

Normally, economies get going out of an economic slide because of deficit spending by the government and interest rate cuts by the central bank (in our case, the RBA). The deficit spending supports personal incomes and confidence, the interest rate cuts support fixed investment and asset prices (house prices, share prices and so on) and also help the currency decline, which stimulates growth. But the government is committed to slashing the deficit, the RBA has (as yet!) given no sign it wants to cut interest rates, and the Australian Dollar remains stubbornly high. Our belief is that the RBA will revise its policy; that the A$ will fall; but it is very much less likely that the government will concede, and reverse track.

Interesting times.