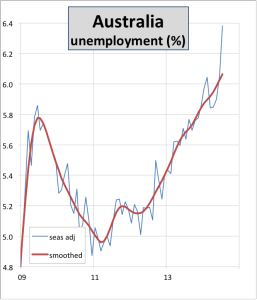

Yesterday’s increase in the Australian unemployment rate from 6% to 6.4%, to levels not seen for 12 years, was unexpectedly large.

It had become obvious over the last few months that the economy was struggling. In last weeks Sira Views, we mentioned our concerns that the economy would weaken and unemployment would rise over the next few months. However, the jump surprised even us.

It needs to be said that these data are “spiky”—in other words they fluctuate a lot around the trend. The fluctuations are because this is based on a relatively small sample survey. The Australian Bureau of Statistics survey directly asks just 0.32% of Australia’s adult population about their employment status, and the numbers then have to be “scaled up” to cover the whole population. This means that there are month to month fluctuations which are purely random and have nothing to do with the underlying “economic truth”.

It needs to be said that these data are “spiky”—in other words they fluctuate a lot around the trend. The fluctuations are because this is based on a relatively small sample survey. The Australian Bureau of Statistics survey directly asks just 0.32% of Australia’s adult population about their employment status, and the numbers then have to be “scaled up” to cover the whole population. This means that there are month to month fluctuations which are purely random and have nothing to do with the underlying “economic truth”.

The best guess to the underlying reality is the “smoothed” series (the red line in the chart above). For example, as you can see in the chart, there was a big jump in the unemployment rate in September 2012 which was reversed in the next couple of months, but the trend continued to rise, and by March 2013, the unsmoothed data had surpassed the September peak. Right now the trend is strongly up. So it is likely that even though the “unsmoothed” unemployment rate might stabilise or fall a little over the next couple of months, the trend in the unemployment rate, which represents the underlying economic reality, will keep rising.

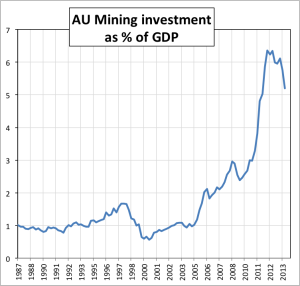

The key reason for this is that the capital expenditure associated with the mining boom has peaked and its decline will take about 5% off Australia’s real (or “inflation-adjusted”) GDP. Before the mining boom, mining capex averaged about 1 to 1.5% of GDP. Now that the major projects have been completed, and given the unlikelihood of new ones being started, mining capex should subside from the current 5.2% back towards its long-term value.

This detraction from real GDP will most probably not be fully offset by a resurgence in other sectors, especially if confidence remains weak. And confidence won’t be helped by damaging headlines about unemployment! Wage increases are at a 16 year low; unemployment is surging; the political rhetoric is very negative …. Even house price increases appear to have slowed.

This detraction from real GDP will most probably not be fully offset by a resurgence in other sectors, especially if confidence remains weak. And confidence won’t be helped by damaging headlines about unemployment! Wage increases are at a 16 year low; unemployment is surging; the political rhetoric is very negative …. Even house price increases appear to have slowed.

While we foresee weakness in the Australian economy over the next couple of years, we don’t see a full-blown recession. World growth is holding up, and even though some of our key export commodity prices (iron ore and coal) are weak, LNG prices remain strong. Meanwhile, export volumes have grown and will keep on growing as the mining infrastructure already installed allows shipping volumes to rise. What it does mean though is that the RBA won’t be raising the cash rate any time soon.