Most of our forecasts made this time last year have proved right, except one. As predicted, the A$ has fallen further, commodity prices and resource stocks have continued to decline, US interest rates have started rising, and world growth has continued. However, we also forecast a “moderate” rise in the share market. Instead the All Ordinaries index has fallen about 5% over the year.

Most of our forecasts made this time last year have proved right, except one. As predicted, the A$ has fallen further, commodity prices and resource stocks have continued to decline, US interest rates have started rising, and world growth has continued. However, we also forecast a “moderate” rise in the share market. Instead the All Ordinaries index has fallen about 5% over the year.

Why did this happen?

The answer lies in the nature of the stock market indices in Australia. About 25% of the broad indices such as the All Ordinaries index is made up by banks. Over the last year, the Reserve Bank and APRA have tightened prudential regulations for banks, building societies and credit unions. They did this because they were concerned that rapid growth in house prices and in the issue of new mortgage loans risked financial instability in the future. The banks were asked to restrict the growth in credit advanced to investors in the housing market to 15% per annum. Also, the risk ratings on mortgages were increased which meant that lending institutions had to hold more capital (shareholder funds and reserves) against their mortgage loan book. This mean that the banks’ return on capital employed (“ROCE”) fell, and they also needed more capital as well, a double blow.

Banks had been steady performers in the share market over the previous 10 years. They offered high yields and some growth in earnings and as a result their share prices rose. The changes imposed by the Reserve Bank and APRA meant that bank shares fell, and since banks were such a significant part of the index, the overall index fell too. Other “blue chip” shares such as Woolworths, BHP, Rio, and Telstra also fell, though each one for different reasons. But that didn’t mean that all the shares comprising the All Ordinaries index fell. In fact our portfolios held shares in other sectors of the share market which were level or even rose, and our small caps portfolio, consisting of companies with a market capitalisation of under $2 billion, rose 29% over the year.

So what does the future hold? Well, what we said last year pretty much applies this year. The US economy is still growing. It will be its eighth year of upturn. Europe has started to grow again after the declines caused by the Greek debt crisis. China is still growing, but more slowly than it has for years. Australia will continue to grow, but growth will remain below the long term average. Inflation remains low almost everywhere. Commodity prices are likely to continue to decline, though the rate of decline will likely slow. The Australian dollar will fall further. Even after the small rise in US interest rates, world interest rates, and Australian interest rates will remain at or close to record lows. World stock markets will grind higher, punctuated by periodic corrections.

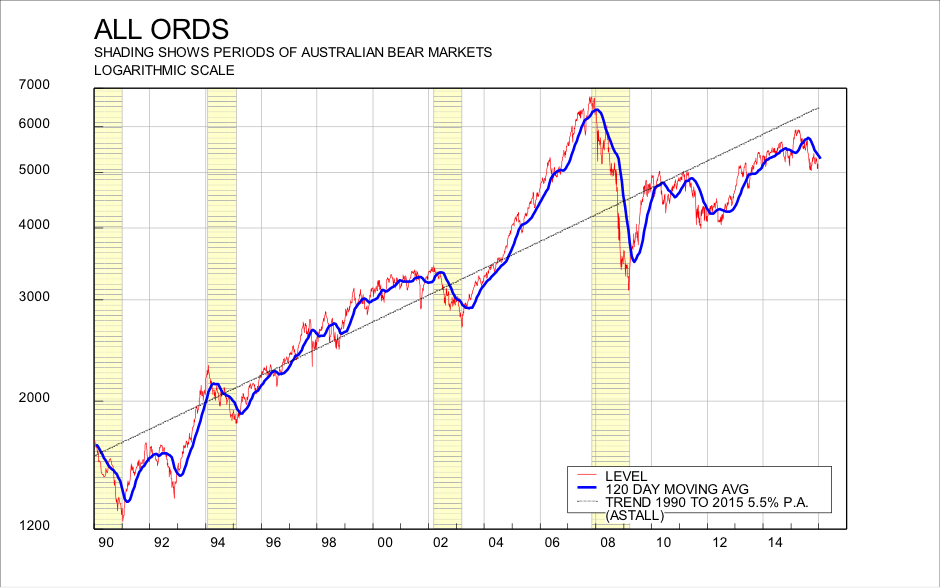

In Australia, the banks have now raised the capital they need, and have upped their interest margins by raising the mortgage rate even though the cash rate set by the Reserve Bank hasn’t risen. So they are likely to start rising in price again, which will help the All Ordinaries index post decent gains over the year. In the past, as you can see from the attached chart, when the All Ords is substantially below the long term moving average, it tends to rebound back towards it. We believe that will happen again this year. Meanwhile, because the behaviour of the different sectors making up the market will vary just as it did this year, stock selection—in other words, good portfolio management—will be more important than ever.