Stock market soothsayers will tell you that “bull markets climb a wall of worry”. What they mean by this is that great optimism is not conducive to big rises in the market. The more optimistic commentators and market participants are, the more likely it is that “everything is in the price”, in other words because the optimism is fully reflected in share prices, there’s nothing left to drive the market higher. The converse is also true: when everybody is pessimistic, it’s usually a good idea to buy shares. And right now there is no shortage of things to be pessimistic about.

Let’s start with the obvious. The Australian economy is close to recession. Wages growth is at 20 year lows, and is likely to fall further; unemployment is rising; confidence, both business and consumer, is sliding; consumer spending is sluggish; and other than in mining, production is sliding. Behind all these factors lie the plunge in commodity prices and the end to the mining investment boom. A big fall in interest rates would help, mainly because it would drive down the Australian dollar. But the Reserve Bank (RBA) is unwilling to cut the cash rate further because it (rightly) fears triggering an unsustainable house price bubble. If specific measures to restrain house lending are implemented, as has been advised by the Murray commission, the RBA may be more willing to cut rates. Until then, the economy will go on deteriorating. Our guess is that the RBA will be forced to cut interest rates by half a percent, and perhaps by as much as one percent, over the course of the next 12 months.

Let’s start with the obvious. The Australian economy is close to recession. Wages growth is at 20 year lows, and is likely to fall further; unemployment is rising; confidence, both business and consumer, is sliding; consumer spending is sluggish; and other than in mining, production is sliding. Behind all these factors lie the plunge in commodity prices and the end to the mining investment boom. A big fall in interest rates would help, mainly because it would drive down the Australian dollar. But the Reserve Bank (RBA) is unwilling to cut the cash rate further because it (rightly) fears triggering an unsustainable house price bubble. If specific measures to restrain house lending are implemented, as has been advised by the Murray commission, the RBA may be more willing to cut rates. Until then, the economy will go on deteriorating. Our guess is that the RBA will be forced to cut interest rates by half a percent, and perhaps by as much as one percent, over the course of the next 12 months.

Europe is struggling to spark sustainable growth, after 6 years of stagnation. Even the Japanese “two wasted decades” produced an average growth rate of 2% per annum. In Europe, real (inflation-adjusted) GDP is still below the peak reached before the GFC. And growth is faltering. Good cause for pessimism. And yet, budget deficits across Europe are falling, so some modest fiscal stimulus is now possible, and the European Central Bank (ECB) is well aware of the risks and will take action soon.

China is undergoing a major shift in the structure of its economy, from an investment-driven to a consumer-led economy. As part of this process, the government is targeting a more moderate growth rate of 7-8% instead of the breakneck pace of 10-12% of the last two decades. The good news is that the Chinese government will easily be able to stimulate growth if it falls too low, because there is huge pent-up demand. The bad news (for Australia) is that because there has been a jump in supply of minerals as new mines have opened, 7-8% growth is not enough to sustain commodity prices.

US growth is accelerating. Employment growth is rising, wages are rising, business and consumer confidence are improving. But even here there is cause for pessimism. The US cash rate has stuck at 0% for 6 years, an emergency rate to counter the effects of the GFC. Now that the economy is recovering, the Federal Reserve Bank will want to start normalising interest rates. Which means that at some point during 2015, US interest rates will start rising, and this is likely to restrain the US share market, with flow-on effects to our share market.

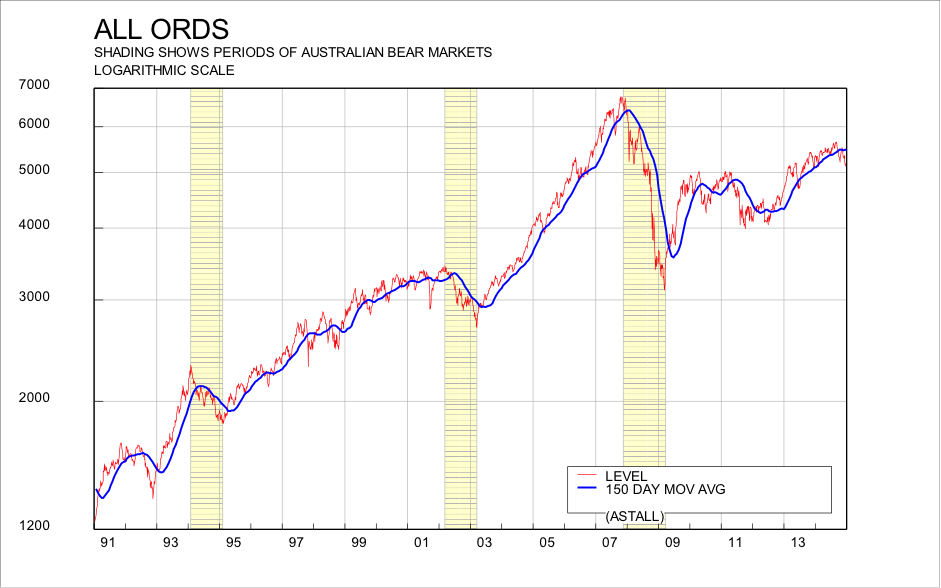

All the same, we believe that there will still be positive returns from Australian shares over 2015. Why do we think that?

The RBA will have no alternative but to cut rates during the year as our economy slows. This will tend to support our share market, particularly since the dividend yield at 4.5% (or 6% including franking credits) is still better than cash, currently 2.5% (and likely to fall.) The Australian dollar will continue to fall, which in the past has always helped support our share market via its effect on profits of Australian companies. Our share market is “cheap” measured either by price earnings ratio or dividend yield. But, even though the share market will rise moderately over 2015, there will be large differences between different sectors within the market. Resources are likely to underperform, whereas companies with US dollar earnings (for example, Westfield or CSL) will do much better. And foreign shares in Australian dollars will also likely beat our market’s performance.