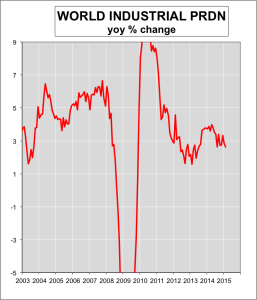

Although you can’t see it in the chart to the left, there are clear signals that world growth is starting to pick up, after the deceleration that took place over the last year.

Although you can’t see it in the chart to the left, there are clear signals that world growth is starting to pick up, after the deceleration that took place over the last year.

The European economy has for 3 years now been stagnant, but there are early hints that it has started to recover. Business surveys are improving and recent economic data have been better than expected (often a sign of a turning point.) This follows the beginning of an aggressive program of QE (Quantitative Easing) by the European Central Bank (ECB) as well as a big plunge in the Euro. The two occurrences of course are not unrelated. The Euro has fallen 25% against the US$. A fall this big will materially stimulate exports and slow imports. It will encourage demand in Europe, not just from rising exports, but from tourism too, and from the consequent boost to consumer and business confidence. This doesn’t mean Europe will boom, but moderate growth will resume—and that’s a significant improvement.

Chinese growth has slowed (to a still respectable 7.5%) but the Chinese authorities have over recent months taken some more measures to stimulate the economy, such as cutting interest rates and reducing some restrictions on housing investment. The first signs that growth is starting to pick up have become evident. This doesn’t mean that China will push growth back to 9 or 10%—this helter-skelter growth in the past caused too many problems—but it does mean that Chinese growth has probably passed its low point for this cycle.

The US has been weak over the last few months due to a cold snap which hit the more densely populated areas of the country. As the freezing conditions give way to summer, indicators are expected to rebound. Consumer confidence has returned and growth is expected to stay at around 2.5%.

None of these shifts suggest a runaway boom! But the small but significant improvement in world growth will help support at least some of Australia’s export commodities, which will be good news for our own growth rate.