All sorts of indicators suggest that world growth is picking up. In the US, Q1 weather-related weakness has reversed; in Europe, stimulus via QE (Quantitative Easing) and a zero cash rate has finally kick-started growth; in India growth is picking up; leading indicators we watch point towards global recovery.

All sorts of indicators suggest that world growth is picking up. In the US, Q1 weather-related weakness has reversed; in Europe, stimulus via QE (Quantitative Easing) and a zero cash rate has finally kick-started growth; in India growth is picking up; leading indicators we watch point towards global recovery.

In the past, a global recovery would also have led to a rise in commodity prices. And yet, that hasn’t happened. Commodity prices, and the market prices of those commodities all-important to Australia, coal and iron ore, continue to decline. So what’s happening?

The rise of China has altered the dynamics of commodity markets. China is the world’s largest consumer of commodities, and if Chinese demand is zooming, then commodity prices should be too. According to official estimates Chinese GDP is still growing by 6.9%, which is double the US’s growth and triple European or Japanese or Australian growth. So why aren’t commodity prices rising?

The reasons are various.

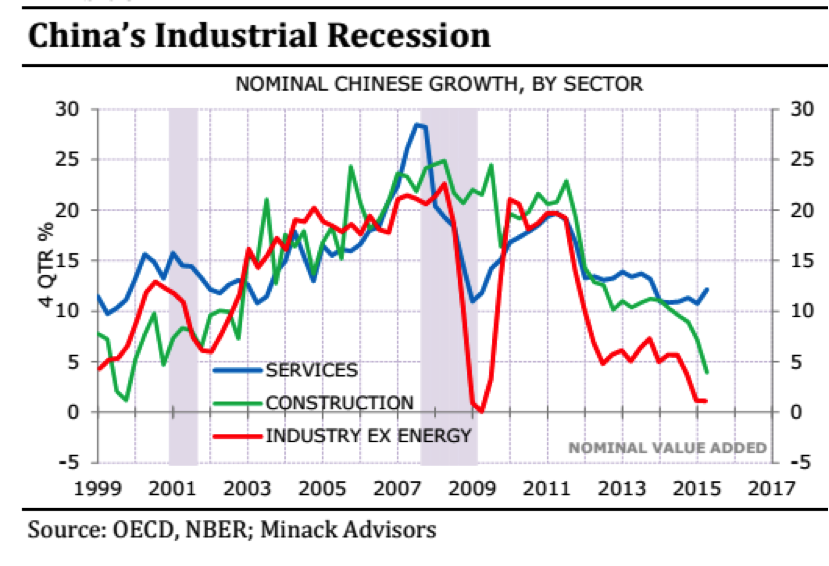

Even though Chinese growth is high relative to ours, it’s lower than it was. From 2004 to 2007, China’s GDP growth was a scintillating 12% per annum. From 1992 to 2007, growth averaged 10% per annum. So, relative to that history, China’s growth is low, even if by the standards of the rest of the world it’s doing well. Moreover, Chinese growth isn’t going to accelerate back to those historic highs for several reasons. As developing economies expand, their growth rate slows. Also, preceding booms have led to water, ground and especially air pollution. The previous development dynamic was for massive expenditure on plant and equipment and infrastructure, and the output of all this fixed investment was exported. This added to overall Chinese GDP statistics, but also led to overcapacity. In any case, growth was in a sense export led. And China has got too big for Europe and America to sit idly by while she grew exports at the expense of their domestic industries.

So the Chinese government is targeting lower growth and also a different growth composition. Fixed investment will form a lower percentage of a more slowly growing economy. Instead, growth will come from consumer goods and services, and these use far fewer minerals than investment and industrial production do. As regards the coal price in particular, China has started the process of transitioning to a carbon-free economy, so that even though electricity demand is still growing, coal demand is not.

At the same time, there has been a large increase in the supply of most minerals. High prices five and ten years ago encouraged the development of new mines and the infrastructure needed to ship minerals to world markets.

At the same time, there has been a large increase in the supply of most minerals. High prices five and ten years ago encouraged the development of new mines and the infrastructure needed to ship minerals to world markets.

And, finally, the strengthening US dollar has reduced commodity prices. Apart from wool (which is priced in Australian dollars) and tin (which is priced in Malaysian ringgit) most commodity prices are set in US dollars. The strength in the US dollar is likely to continue for many months.

The implications of this analysis are that growth outside China will have to pick up substantially to offset the slowing commodity demand within China, or that mines will have to be mothballed to reduce supply. So far, supply cutbacks have been minimal as investors and operators have been (naturally) reluctant to close down mines after having spent billions creating them. On the demand side, even though world growth is starting to re-accelerate, the world outside China is still growing far too slowly to compensate for the slowdown in purely Chinese demand. In other words, commodity prices will only stabilise when higher cost mines start to close. That process appears to have started, but will need to go much further before commodity prices bottom. Until then, weak commodity prices will continue to hold Australian growth back, even as world growth picks-up.