What happens in the world economy matters to Australia. World growth is a key driver of commodity prices, and most of Australia’s exports are commodities. The top three commodities, coal, iron ore and gold, account for 45% of our exports. Over the next few years LPG/LNG will become very important too. Gas price contracts are often linked to the oil price, so falling oil prices affect us too.

The United States and Europe contribute equal amounts to the world economy, roughly 22 percent each. China is probably still smaller than the US (its numbers are a bit rubbery) but it’s something like 15-18% of the world economy now. What is certain is that China is the world’s largest consumer of raw materials, and is the largest market for our exports. Japan (7%), India (5%), Russia and Brazil (3% each) and Mexico, Canada, Turkey, Taiwan and Korea together make up another 25%. The rest comes from myriad smaller economies.

So the key to projecting world growth is to understand what’s happening in the USA, Europe and China, though other economies do have some influence.

The US economy is growing strongly. Not as strongly as in previous cycles, but certainly enough to drive down the unemployment rate and increase personal incomes faster than inflation. There are no signs of the sort of excesses (house price booms, inflation, over-lending, etc.) which typically precede an economic bust. US growth is ‘safe’.

The US economy is growing strongly. Not as strongly as in previous cycles, but certainly enough to drive down the unemployment rate and increase personal incomes faster than inflation. There are no signs of the sort of excesses (house price booms, inflation, over-lending, etc.) which typically precede an economic bust. US growth is ‘safe’.

This is not true for Europe. Europe is stagnating. Its GDP is still way below the peak reached before the GFC, and most economic indicators have started to decline again. Part of the problem is an unwillingness to reform outmoded labour force laws and welfare structures, but more is due to reluctance by the European authorities and the ECB to stimulate growth by using the measures the US took: deficit spending and massive monetary stimulus.

In China, growth at around 7.5% is still high by the standards of developed countries, but is much lower than China’s own history. And although the Chinese authorities could force faster growth, they don’t want to because previous breakneck growth rates created severe political, social, economic and environmental problems. The good news is that this growth rate is also likely to be sustainable over several years.

Outside China, Japanese growth is picking up but Russia and Brazil are sliding.

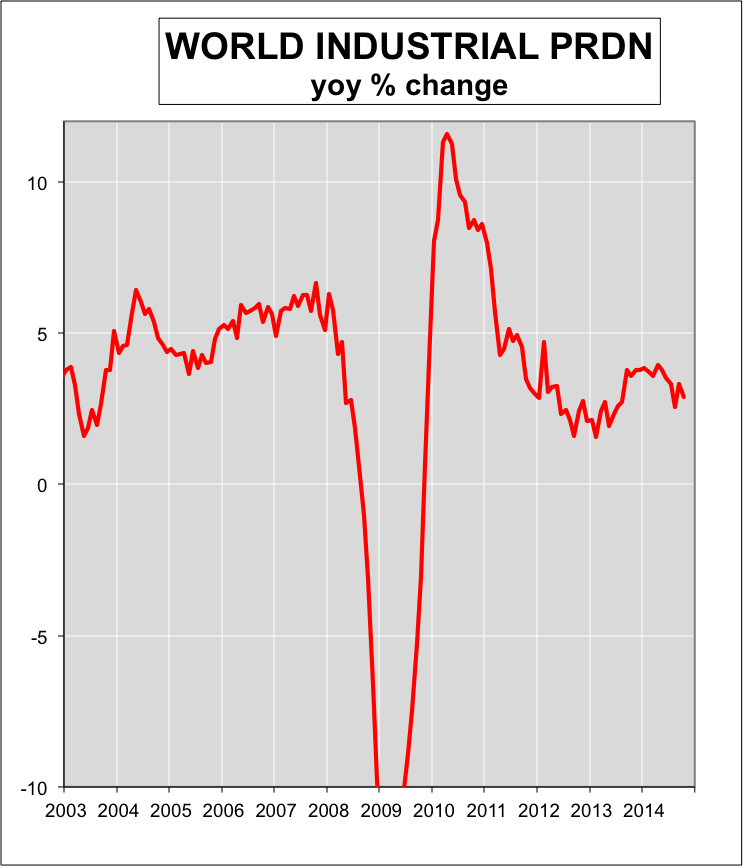

So for the world as a whole, growth is slowing mostly because Europe is slowing. That is not to say that a new recession is on the way. It isn’t. But until Europe turns up again, which could be many months away, the prices of our commodity exports will remain under pressure.