Almost all investments give you two different sources of return: capital gains and income. Shares are no different, except that the income is called dividends.

In the long run, though, the capital gains from shares don’t happen in a vacuum. They too depend on dividends/profits. In reality, ultimately all the return from shares depends directly or indirectly on dividends and how they grow.

Having said that, it is possible to have short-term capital gains without dividends changing. Logically, if interest rates halve, say from 5% to 2.5%, then, everything else being equal (and it never is!), share prices should double, because the dividend is worth twice as much. To understand this, imagine that the day before the interest rate halves, your shares will deliver, say, $100 in dividend income. Assume that a deposit at your bank also earns $100, before the interest rate cut. After the cut, you will only get $50 from your deposit at the bank, but you will continue to get $100 from your shares. The shares have (again, everything else being equal) become twice as attractive relative to deposits.

Obviously the opposite is also true. If interest rates rise, then the share market becomes less valuable. Rising interest rates are often a cause of a “bear market” in shares.

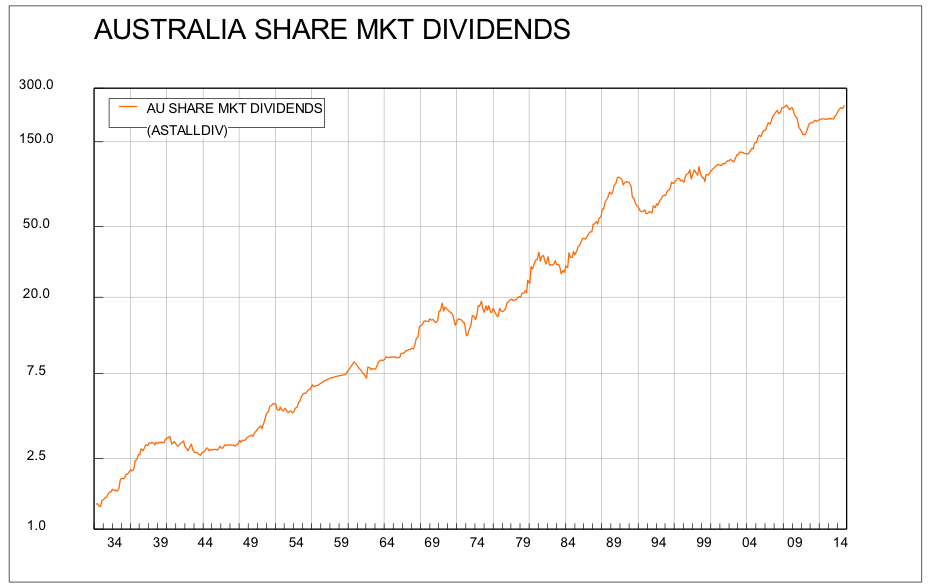

At the same time, it is also true that profits (and therefore dividends) fluctuate over the course of the business cycle. In the chart left (which is plotted using a logarithmic scale) you can see how dividends have grown steadily over time, but with fluctuations around the long term uptrend. This is the underlying long term driver of share market returns. Since 1932, the dividends on the share market have risen nearly 250 times, at an average annual compound rate of 6.4%. There have been periods of decline, but in the long term the trend is unambiguously up.

At the same time, it is also true that profits (and therefore dividends) fluctuate over the course of the business cycle. In the chart left (which is plotted using a logarithmic scale) you can see how dividends have grown steadily over time, but with fluctuations around the long term uptrend. This is the underlying long term driver of share market returns. Since 1932, the dividends on the share market have risen nearly 250 times, at an average annual compound rate of 6.4%. There have been periods of decline, but in the long term the trend is unambiguously up.

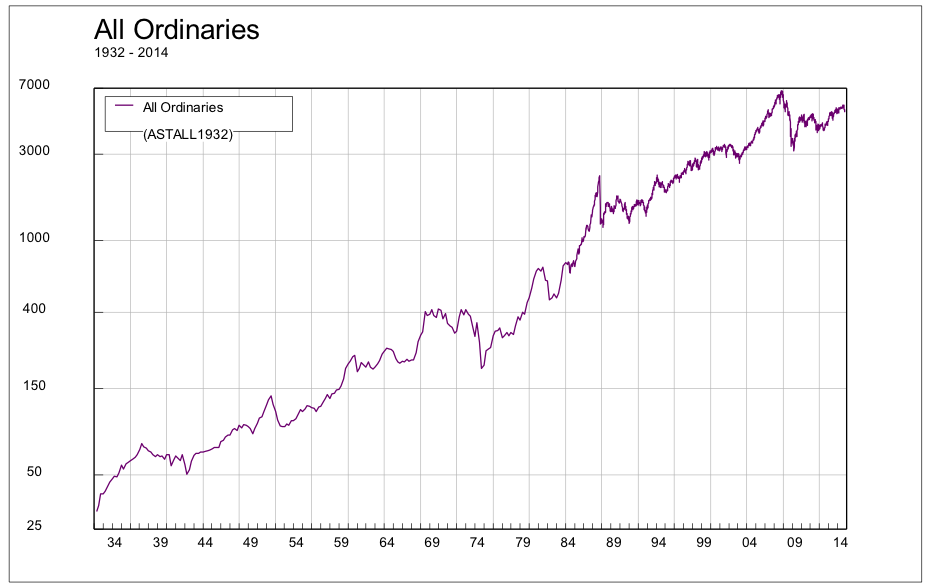

With this underlying support, it’s not surprising that the share market index itself has likewise risen dramatically over the last 80 years. In fact, over this period the share market has risen by 6.4% per annum, almost exactly in proportion to the rise in dividends.

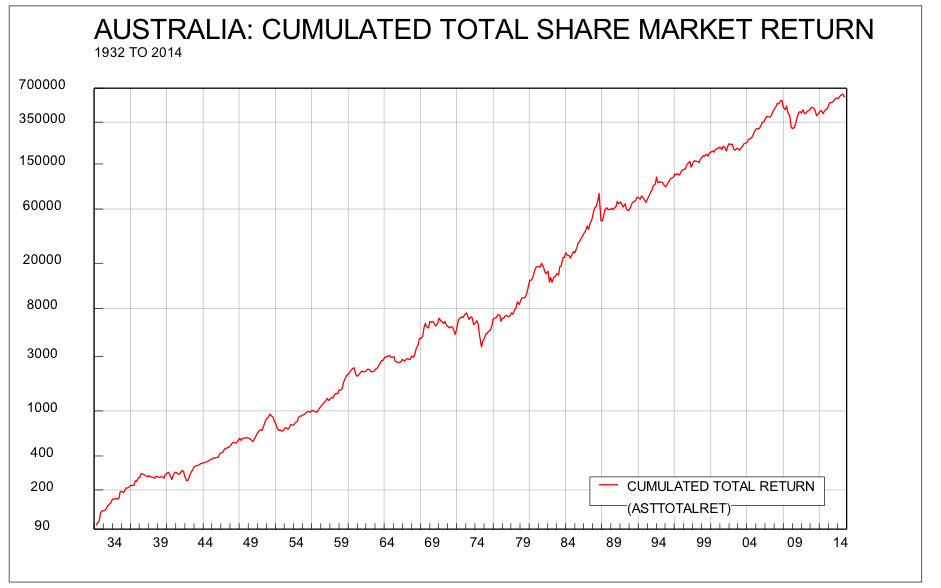

But as we said at the beginning, the total return for an investment in shares is not just capital gains. You have to include dividends paid. These nearly double the effective long term return from shares.

But as we said at the beginning, the total return for an investment in shares is not just capital gains. You have to include dividends paid. These nearly double the effective long term return from shares.

Since 1932, the annual compound total return on the share market (dividends plus capital gains) has been 11.3% per annum (see chart below). If you had invested $100 in the share market in 1932, and reinvested all the dividends, it would now be worth $700,000. Since 2000, the total return has been somewhat lower: 7.9% per annum (you can see the dip in the chart in 2007 and 2008, caused by the GFC). That would nevertheless still mean that you tripled the value of your portfolio over that period. Over the last 10 years, the total return has been 9.7% per annum, giving a 2.5 times total increase.

However, even if shares deliver an excellent return over longer periods, on time scales of one or two years, returns can be seriously negative. Human nature being what it is, we often tend to focus more on the short term negatives rather than the longer term positives.

However, even if shares deliver an excellent return over longer periods, on time scales of one or two years, returns can be seriously negative. Human nature being what it is, we often tend to focus more on the short term negatives rather than the longer term positives.

So is it a good time to invest in shares now? We would argue yes. Although Australia is probably going to have a period of slow growth over the next couple of years, this will mean that the cash rate won’t rise, which supports the share market. Economic growth will continue even if it is perhaps slower than what we have become used to, which means profits and dividends will continue to rise, propelling the market to new highs.

The nature of the stock market is to exhibit waves of advance and decline around a rising trend. After an unusually long period of decline, it appears that a new up wave has begun.