Among the most closely watched economic statistics in Australia are the employment data from the Australian Bureau of Statistics (the ABS): the unemployment rate, the level of total employment, and the split between full-time and part-time employment. And in July we had the odd spectacle of the unemployment rate jumping from 6.1 to 6.3% in July (after a few months when the rate has been falling) at the same time that total employment actually rose, by a strong 38,000. You might ask how this can be. On the face of it, it seems inconsistent.

Among the most closely watched economic statistics in Australia are the employment data from the Australian Bureau of Statistics (the ABS): the unemployment rate, the level of total employment, and the split between full-time and part-time employment. And in July we had the odd spectacle of the unemployment rate jumping from 6.1 to 6.3% in July (after a few months when the rate has been falling) at the same time that total employment actually rose, by a strong 38,000. You might ask how this can be. On the face of it, it seems inconsistent.

It could be that employment growth is slower than the growth in the labour force, which would mean that even though employment is rising, it’s not rising fast enough to “use up” the increased supply of labour. That’s certainly a partial reason.

A larger part of this discrepancy is in all probability statistical error. The national unemployment rate is not exactly 6.3%. In fact the ABS tell us that it’s somewhere between 5.9% and 6.7%. Similarly, the rise in total employment wasn’t exactly 38,500. It was somewhere between a fall of 19,500 and a rise of 96,500. These are the 95% confidence limits of the ABS’s estimates. This means that the statistician is 95% confident that these numbers are within these ranges. So maybe the unemployment rate in fact fell in line with the rise in employment, if we only knew. Or conversely, maybe it was employment which fell, in line with the rise in the unemployment rate.

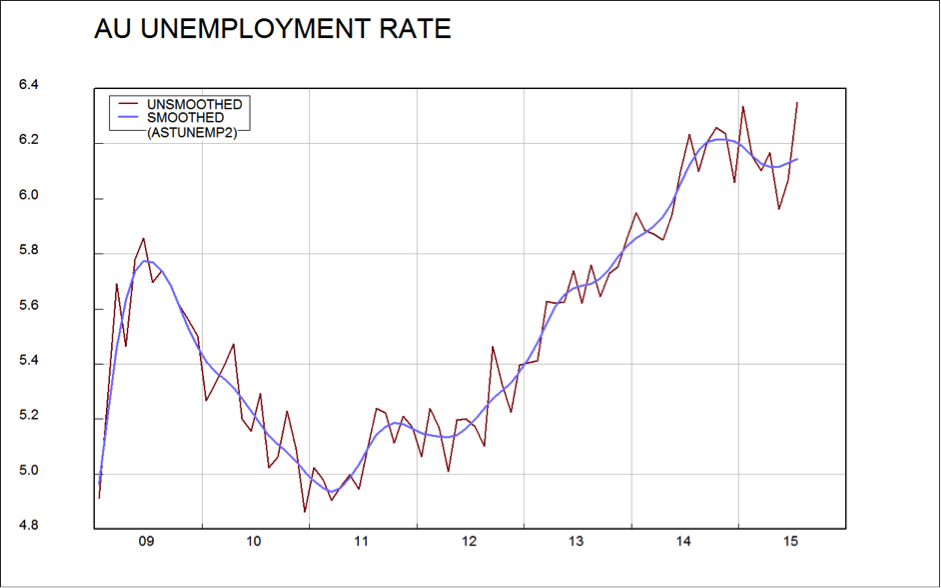

This doesn’t seem very useful, does it? But you can get greater insight from the data by smoothing them. This is what the ABS calls the “trend” or “smoothed” series (you can see the difference in the chart below). The logic is that the “error term”, which is the difference between the real number and our estimate of it, ought to fluctuate in a random way around zero. Which means that the smoothed (or “trend”) series will have much smaller errors than the unsmoothed, because one month the “error term” might be positive, and the next negative, producing an average close to zero.

Now this is where it gets interesting. On a smoothed basis, employment growth has been falling steadily. In January, total employment was rising at 27,300 a month, but each month since, the increase has been smaller, so that by July total employment was increasing by just 17,800 per month. And on a smoothed basis, the unemployment rate was falling earlier this year but is now rising. This is more consistent than the story given by the unsmoothed month-on-month movements.

Now this is where it gets interesting. On a smoothed basis, employment growth has been falling steadily. In January, total employment was rising at 27,300 a month, but each month since, the increase has been smaller, so that by July total employment was increasing by just 17,800 per month. And on a smoothed basis, the unemployment rate was falling earlier this year but is now rising. This is more consistent than the story given by the unsmoothed month-on-month movements.

It is also more consistent with what we believe is happening in the economy, namely that economic growth will remain below its long term average, which would mean that jobs growth will be slow, too slow to prevent the unemployment rate from rising. It’s bad news for job seekers, undoubtedly. From an investment perspective, however, this is an environment in which the cash rate is unlikely to rise, but is also one not bad enough to cause big falls in the share market.

Meanwhile, don’t be surprised if the ABS revises the numbers in next month’s release.