The US Federal Reserve Bank (the “Fed” – the US equivalent of the Reserve Bank of Australia) has raised interest rates by 0.25%. This is the first rise in US rates since 2006.

The US Federal Reserve Bank (the “Fed” – the US equivalent of the Reserve Bank of Australia) has raised interest rates by 0.25%. This is the first rise in US rates since 2006.

So why has the Fed raised interest rates and what does that mean for investment markets?

The US fed funds rate (their version of Australia’s cash rate) has been close to zero since the GFC, the deepest recession since the great depression of the 1930s. The fed funds rate was cut to near zero in 2008 by the Fed to stimulate the economy after the GFC. The economic recovery took a while to gather strength, and in fact so slow was the recovery that the Fed took the extraordinary step of buying government bonds and funding this with “printed” money. This was called Quantitative Easing, or QE for short. This is a different process from cutting interest rates, but because the fed funds rate was practically zero and couldn’t be lowered any more, additional measures to stimulate activity were required. QE was ended a year ago, and since then the Fed has been strongly hinting that rates would have to rise at some point.

An economy is in one regard like an oil tanker: it can take a long time to stop or to start. Central banks like the Fed or the RBA have to move in advance of a rise in inflation, because by the time inflation is evident, it may have become embedded in the economy. The fact is that if a central bank waits too long, it may have to raise interest rates by more than if it acts early, and this would risk pushing the economy into recession. So even though inflation remains low in the US, thanks to falling oil prices among other things, the unemployment rate has fallen to 5%, and forward indicators of wage inflation suggest that it is likely to accelerate over the next year. Also, the near-zero fed funds rate was set as an emergency measure, to kick-start the economy. And the economy is well into its recovery, so emergency measures are no longer required.

The Fed is unlikely to raise rates aggressively. They will move cautiously, waiting to see the effects of each move. In the post-GFC environment, several central banks have raised rates and have been forced to reverse course soon after. This may yet apply to the Fed too.

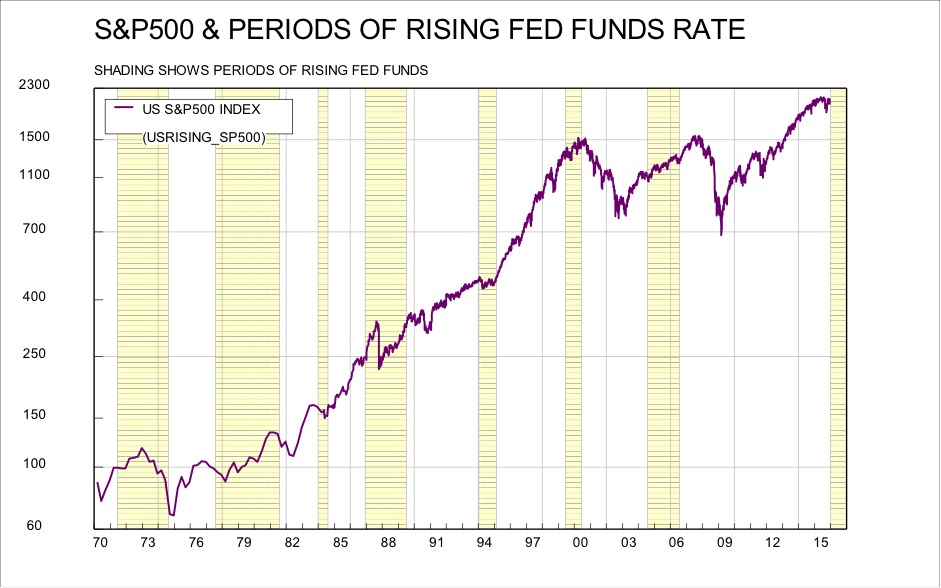

This rise in rates in the US is unlikely to have much effect on the share market, here or in the US. As you can see from the chart below, the US share market often rises during periods of a rising US fed funds rate. What does cause the US share market to fall is recessions. But the US is very unlikely to have a recession in the next couple of years, since (a) the Fed will raise rates cautiously and carefully with due cognisance of the data about the economy as it moves forward and (b) there are no signs of the excess (such as house price booms or overinvestment) typically seen before recessions.

This rise in rates in the US is unlikely to have much effect on the share market, here or in the US. As you can see from the chart below, the US share market often rises during periods of a rising US fed funds rate. What does cause the US share market to fall is recessions. But the US is very unlikely to have a recession in the next couple of years, since (a) the Fed will raise rates cautiously and carefully with due cognisance of the data about the economy as it moves forward and (b) there are no signs of the excess (such as house price booms or overinvestment) typically seen before recessions.

However, rising US interest rates do nudge bond yields higher, and Australian bonds tend to be heavily influenced by US bonds. So US and Australian bond yields are likely to drift higher. Also, since the Australian economy will remain weak as the end of the mining boom is worked out, while the US economy will continue to improve, it remains very likely that the Australian dollar will keep on weakening against the US dollar.