It is an accepted orthodoxy in economics that inflation is A Bad Thing. This is because the price system is an extremely clever invention which provides information to market participants on how to reallocate consumption and production, and it does this without any central control or guidance. The different prices within the overall economy are derived from the interaction of consumers and producers, from the workings of the system itself. If demand for a product increases, it leads to price increases in that product, which signals to producers that supply should be increased. If supply increases, for example because of some technological improvement, the market price falls, persuading more people to buy or the same number to buy more, thus helping soak up the extra supply.

It is an accepted orthodoxy in economics that inflation is A Bad Thing. This is because the price system is an extremely clever invention which provides information to market participants on how to reallocate consumption and production, and it does this without any central control or guidance. The different prices within the overall economy are derived from the interaction of consumers and producers, from the workings of the system itself. If demand for a product increases, it leads to price increases in that product, which signals to producers that supply should be increased. If supply increases, for example because of some technological improvement, the market price falls, persuading more people to buy or the same number to buy more, thus helping soak up the extra supply.

Inflation distorts this skilful mechanism. The signals the price system gives are fuzzed, and so the efficient allocation of resources is made harder: the higher the inflation rate, the worse the impact. Central Banks (such as the Reserve Bank of Australia, the Bank of England, and the Federal Reserve Bank in the U.S.A.) pursue policies which will achieve, or at least attempt to achieve, price stability—usually defined as inflation rates somewhere between 0 and 2 percent.

The catch is that an inflation rate close to zero can easily slip into negative inflation (which is called “deflation”) if economic growth is weak. As well, weak global growth has led to falling oil prices which have reduced inflation almost everywhere. In September, of the 40 most important economies in the world, prices are falling (in other words, there is deflation) in 12 of them. Now from the perspective of a well-functioning price system, deflation is as bad as inflation: it distorts the price system just as adversely. But it also has a serious effect on the financial system, because as prices fall debt becomes a bigger burden. Debt repayments have to be funded from falling income/turnover/revenue, and repaying the debt just keeps getting harder. While a Central Bank can raise interest rates as high as is needed to cut inflation, eliminating deflation is much more difficult: you can’t cut interest rates below zero.

Western economies are heavily indebted. On the whole, governments, individuals and corporations across the world have much more debt than they did 10 or 20 years ago. Low or negative inflation rates mean that the existing debt burden will make economic recovery harder. This is not just theory: for 20 years until recently, Japan has had consistently falling prices, and stagnant growth. And historically, the deflation of the Great Depression in the 1930s was both the result and the cause of deep economic decline. Some commentators have even advocated a temporary increase in Central Bank inflation targets at the present time to avoid or mitigate this potentially pernicious feedback taking hold.

Western economies are heavily indebted. On the whole, governments, individuals and corporations across the world have much more debt than they did 10 or 20 years ago. Low or negative inflation rates mean that the existing debt burden will make economic recovery harder. This is not just theory: for 20 years until recently, Japan has had consistently falling prices, and stagnant growth. And historically, the deflation of the Great Depression in the 1930s was both the result and the cause of deep economic decline. Some commentators have even advocated a temporary increase in Central Bank inflation targets at the present time to avoid or mitigate this potentially pernicious feedback taking hold.

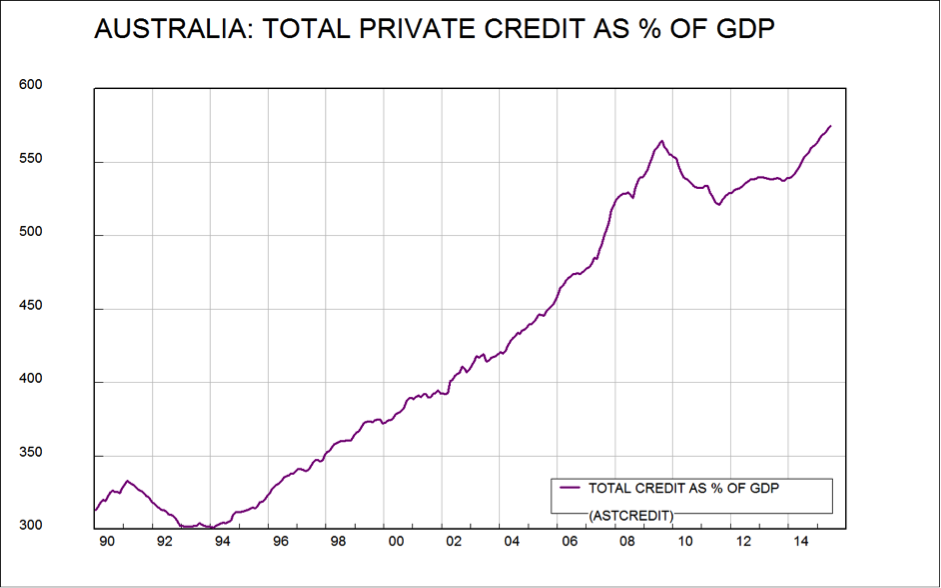

Australia is no exception to these trends. True, we have low levels of government debt to GDP, but private sector debt is very high, and inflation rates are low, though not quite as low as in other developed countries. Wage inflation (another component of and contributor to the workings of the price system) is at record lows. Add considerable uncertainty about economic conditions to low wage growth and already high levels of debt, and it is not really surprising that consumers are holding on to their wallets. After a long battle to cut inflation, the RBA will be understandably most reluctant to take risks with future inflation. So it will not cut the cash rate as much as might be needed to offset the chilling effect on economic growth of Australia’s high personal debt, which is in turn another reason to believe that Australia’s economic recovery over the next few years will be slow and laborious.