Over the last few months, the Australian share market, as measured by the All Ordinaries index is down 12%, so we are now officially in a correction.

Over the last few months, the Australian share market, as measured by the All Ordinaries index is down 12%, so we are now officially in a correction.

Why has the market fallen?

- The correction has so far been concentrated in resources and banks, resources because commodity prices such as oil, coal and copper continue to decline, and banks because regulatory changes have forced the banks to increase their capital. Banks and resources constitute more than 35% of the total share market.

- A few months ago, China had looked as if it was starting to recover, but recent data suggest that that recovery will be delayed, and this has affected sentiment across most world stock markets given China’s importance to the world economy.

- In the US, it is widely expected that the US Central Bank, the Federal Reserve Bank (or Fed) will start slowly raising interest rates. In the past, when this has happened, US share prices have fallen by 8-10%.

- Australian profits growth, while still positive, has disappointed.

Is this the beginning of a bear market?

A bear market is a prolonged and deep decline in share prices, ranging from 20 to 50%. Periodic corrections in a rising trend, on the other hand, are common, and are a healthy phenomenon, because they help take the steam out of a rising market and the overoptimism which can develop. We doubt very much that this is the beginning of a bear market, because:

A bear market is a prolonged and deep decline in share prices, ranging from 20 to 50%. Periodic corrections in a rising trend, on the other hand, are common, and are a healthy phenomenon, because they help take the steam out of a rising market and the overoptimism which can develop. We doubt very much that this is the beginning of a bear market, because:

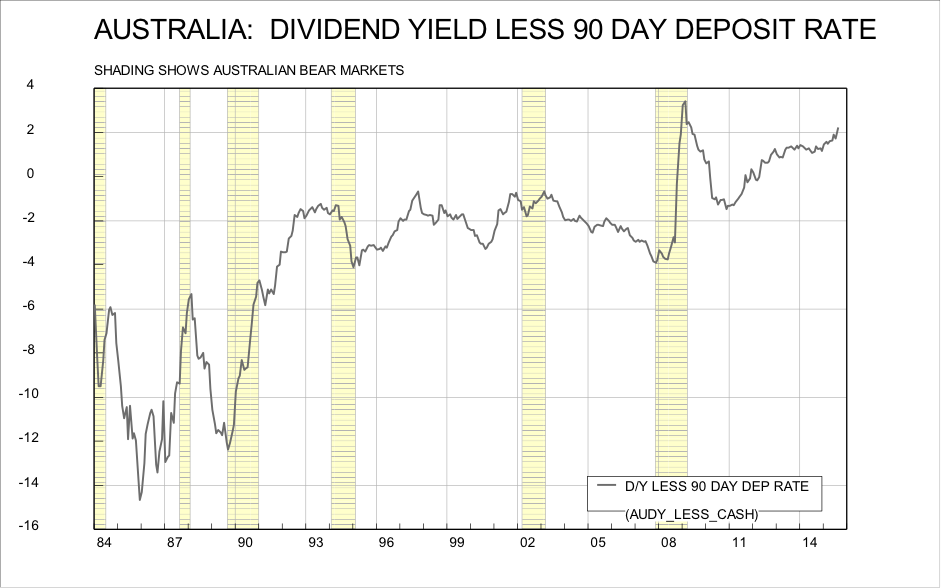

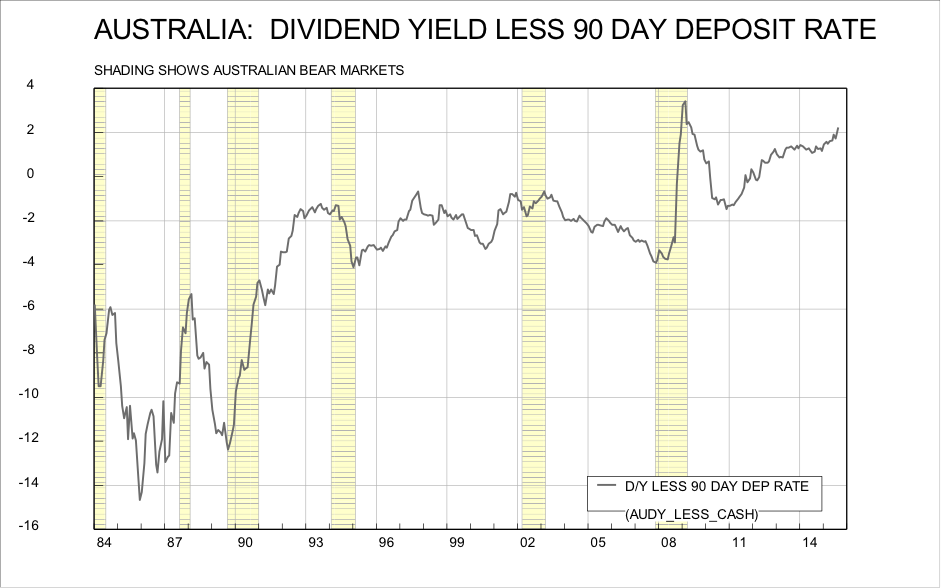

- Shares are not expensive. Even though PERs (price-earnings ratios) appear high, bond yields and the cash rate are at 60 year lows; and dividend yields (even without franking credits) far exceed short-term interest rates. In fact the last time dividend yields were this high relative to the cash rate was at the bottom of the bear market during the GFC in 2009 (see chart), which turned out in retrospect to be a very good time to buy.

- Bear markets are always preceded by excessive optimism, tightening monetary policy, rising inflation, and excesses of various kinds (property and borrowing, usually). None of those factors is present now.

- The world economic upswing is far from its peak, even in the US. Elsewhere, economies are sluggish and below capacity, which means that monetary policy will remain accommodative.

- Inflation remains a non-problem. If anything, the concern is for deflationary pressures, with commodity prices especially the oil price still weak, and with inflation indicators remarkably contained. This means that interest rates will remain low.

- Shares are not “flavour of the month”. There is a lot of pessimism about shares out there, and it is an odd fact that share prices peak when optimism is greatest and bottom when pessimism is greatest. It is said that bull markets (rising markets) climb a wall of worry, and die of euphoria. We have quite a lot of the first, and little of the second.

So when will the market bottom?

The best guide to the potential extent of market declines is often what share analysts and fund managers call “technicals”. To cut a long story short, “technical analysis” is the inspection of charts showing the level of share prices as well as measures of sentiment and momentum. All these indicators suggest that the share market is only a few percentage points off its lows.

We remain of the view that the share market will recover, and that the All Ordinaries index will end the year higher than it began it. In the meantime, our portfolios are prudently invested in outperforming shares, with material cash holdings, and we, as always, watch the market and economic and financial indicators closely and carefully ready to adjust portfolios as necessary.

Over the last few months, the Australian share market, as measured by the All Ordinaries index is down 12%, so we are now officially in a correction.

Over the last few months, the Australian share market, as measured by the All Ordinaries index is down 12%, so we are now officially in a correction. A bear market is a prolonged and deep decline in share prices, ranging from 20 to 50%. Periodic corrections in a rising trend, on the other hand, are common, and are a healthy phenomenon, because they help take the steam out of a rising market and the overoptimism which can develop. We doubt very much that this is the beginning of a bear market, because:

A bear market is a prolonged and deep decline in share prices, ranging from 20 to 50%. Periodic corrections in a rising trend, on the other hand, are common, and are a healthy phenomenon, because they help take the steam out of a rising market and the overoptimism which can develop. We doubt very much that this is the beginning of a bear market, because: