There was a sense of relief that the Federal budget, handed down a week ago, wasn’t anywhere near as punitive as the 2014 budget. However, though it is important, the impact of the budget can be outweighed by other factors. The two biggest negatives over the next couple of years are the fall in mining fixed investment and the weakness in commodity prices.

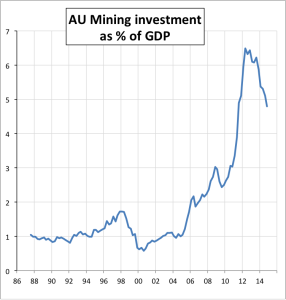

Historically, before the mining boom, mining investment made up more or less 1% of GDP. At the peak of the boom it reached 6.5% of GDP.

Historically, before the mining boom, mining investment made up more or less 1% of GDP. At the peak of the boom it reached 6.5% of GDP.

Inevitably, as projects have been completed, the contribution of mining fixed investment to GDP has declined, and will keep on declining. It seems very likely that it will return to its long-term average. This will take 1 % a year off GDP over the next few years.

At the same time, the prices of our main export commodities have fallen sharply over the last 4 years: coal is down from a post-GFC peak of nearly $140 per tonne to just $57; iron ore from nearly $200 to just $50.

Of course, the volumes exported have risen sharply (which is partly why the prices have fallen so much) so their contribution to real GDP (the volume of GDP) is rising. But the price that output is produced at is falling. So nominal GDP (that is, GDP before removing the effects of inflation) is much weaker than real GDP. The GDP price index, called the implicit price deflator, is falling.

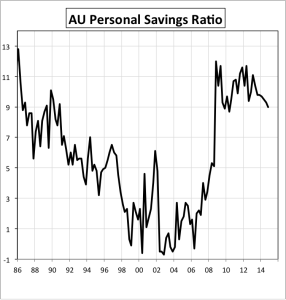

This deflationary pressure has many side effects: sluggish growth in wages (the lowest rate of increase in 30 years); slow growth in tax revenues; and weak consumer and business confidence.  Repaying debt is easier when inflation is high, as the ratio of the debt and of repayments to income falls fast, simply because incomes rise and the debt doesn’t. So consumers, worried about rising inflation, very low income growth and already high ratios of debt to income, have not responded to falling interest rates as they have in previous cycles. The savings ratio has remained stubbornly high. Monetary policy has been remarkbly ineffective this cycle—except in housing.

Repaying debt is easier when inflation is high, as the ratio of the debt and of repayments to income falls fast, simply because incomes rise and the debt doesn’t. So consumers, worried about rising inflation, very low income growth and already high ratios of debt to income, have not responded to falling interest rates as they have in previous cycles. The savings ratio has remained stubbornly high. Monetary policy has been remarkbly ineffective this cycle—except in housing.

In fact, the only section of the economy other than exports doing well is housing, and that is being driven by foreign and investment demand, and has resulted in a surge in house prices in Sydney and Melbourne. This concerns the Reserve Bank. One of the clearest lessons learned from the GFC is that the best way to prevent a housing bubble popping is not to let one start in the first place. So even though the economy is weak and inflation low, the RBA is cutting the cash rate slowly and cautiously.

Without a rise in consumer spending or non-mining fixed investment, and with falling mining fixed investment, GDP growth will remain sluggish over the next few years, and unemployment will drift higher. The unwinding of the resource boom will be a hard road.