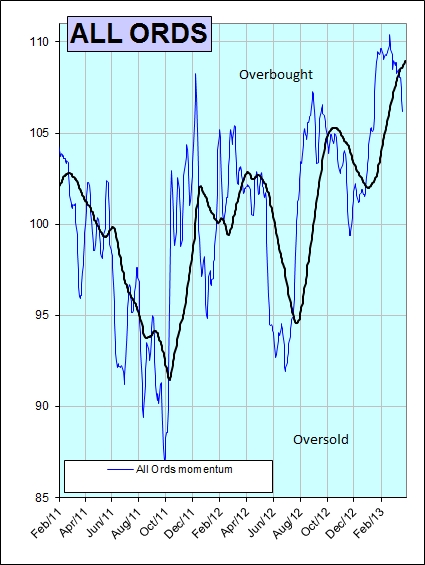

![All Ords 20-3-13[2]](http://siragroup.com.au/wp-content/uploads/2013/03/All-Ords-20-3-1321.jpg) Markets tend not to go in straight lines, on the whole. They instead advance or retreat in waves, each wave higher or lower than the previous one. This is a matter of observation, but the reasons for it are based on logic. If a market (whether it’s for shares, bonds, or currencies) advances in one direction continuously, then traders and investors begin to take that trend for granted. So they start getting too optimistic, and the rising price trend accelerates, which engenders more optimism, and still faster price rises, with the end result that that market “gets ahead of itself”. Overoptimism builds, everyone starts to talk about how “the market can never fall” or “it’s a whole new ball game” (the most expensive phrase in a fund manager’s book!) And then all at once, it becomes apparent to the wiser heads in the market that things have gone too far, so they “take profits’ (i.e., sell) and the market falls (“corrects”) or drifts sideways (“consolidates”) until the overoptimistic perspective is replaced by more neutral sentiments.

Markets tend not to go in straight lines, on the whole. They instead advance or retreat in waves, each wave higher or lower than the previous one. This is a matter of observation, but the reasons for it are based on logic. If a market (whether it’s for shares, bonds, or currencies) advances in one direction continuously, then traders and investors begin to take that trend for granted. So they start getting too optimistic, and the rising price trend accelerates, which engenders more optimism, and still faster price rises, with the end result that that market “gets ahead of itself”. Overoptimism builds, everyone starts to talk about how “the market can never fall” or “it’s a whole new ball game” (the most expensive phrase in a fund manager’s book!) And then all at once, it becomes apparent to the wiser heads in the market that things have gone too far, so they “take profits’ (i.e., sell) and the market falls (“corrects”) or drifts sideways (“consolidates”) until the overoptimistic perspective is replaced by more neutral sentiments.

In the same way, in a collapsing market, the bears become ever more bearish and the decline becomes greater than it should be, until the market is overpessimistic, and rallies—for a while!—before resuming the downtrend.

In the same way, in a collapsing market, the bears become ever more bearish and the decline becomes greater than it should be, until the market is overpessimistic, and rallies—for a while!—before resuming the downtrend.

Since the low point in June, our share market as measured by the All Ordinaries (“All Ords”) index has risen 28%. It’s overbought (a technical measure which tries to give some indication of a market which has gone “too far” in either direction); it’s expensive (trailing PEs are back at the sort of highs where previously the market has turned down); it’s broken down through technical indicators we watch closely; and though a slump in economic growth isn’t at all likely, here or overseas, a boom is also not particularly probable. So we’ve been expecting a “consolidation” for a couple of weeks now.

Is this the beginning of a new “bear market”? No. Economic growth here and overseas will continue. Central banks will continue accommodative monetary policy. Markets and economies will continue to recover from the worst downturn since the great depression in the 1930s. But it is the nature of financial markets that bull markets have “consolidations” and “corrections”. SIRA expects that this consolidation/correction will be modest, and that the uptrend will ultimately resume.