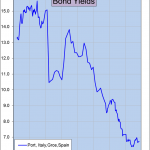

Over the last year or so, the government bond yields of the P.I.G.S. countries—Portugal, Italy, Greece and Spain—have more than halved, reflecting the strengthening belief that the ECB will not allow bond market sell-offs to derail the Euro currency. This improved optimism has in turn been replicated in European and global equity markets.

Over the last year or so, the government bond yields of the P.I.G.S. countries—Portugal, Italy, Greece and Spain—have more than halved, reflecting the strengthening belief that the ECB will not allow bond market sell-offs to derail the Euro currency. This improved optimism has in turn been replicated in European and global equity markets.

But this process is perhaps coming to an end. Greek bond yields are still close to 10%, but in the other PIGS countries, yields are 6% or lower, still way above German or US yields, but also well below the threshold which would trigger intervention by the ECB. And the ECB reluctance to match QE (Quantitative easing) in Japan, the US, and the UK has meant that the Euro has strengthened, a strong headwind for the Euro economies. Which increases the risk of a rerun of the self-feeding crises of the last couple of years.

We’ve had good runs in share markets across the world and in Australia. Time for a pause?

looks good!