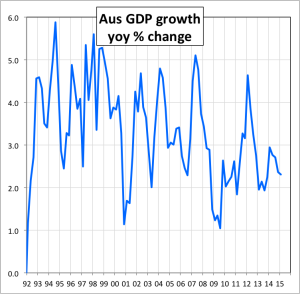

The March GDP figures released on Wednesday showed that growth in the first quarter of this year was 0.9% in real terms. Of that, 0.6% came from the rise in export volumes, which increased 5% in the quarter. This was unexpectedly large, and in fact over the year (“year-on-year”), which is a smoother change, the increase was just 8.1%, a rate of growth in exports roughly where it’s been for the last few years. Another positive component was household consumption, with its contribution to the quarter’s growth adding 0.4%. The big negative was fixed investment which took 0.4% off the quarter’s growth rate. Surveys suggest that private fixed investment is likely to decline over the next few quarters, while government fixed investment is likely at best to stagnate. If the economy continued to grow at 0.9% per quarter, real GDP would rise by 3.6% over the year.  But quarterly data are full of random fluctuations, or to use a non-technical term, they’re very “spiky”. Growth for the 4 quarters to March, a more stable measure, was a less exciting 2.3% (in fact down a little from the previous quarter) and our forecast is that that’s where it’s likely to stay for the next few quarters. By comparison, the average annual GDP growth rate since 1960 has been 3.5%.

But quarterly data are full of random fluctuations, or to use a non-technical term, they’re very “spiky”. Growth for the 4 quarters to March, a more stable measure, was a less exciting 2.3% (in fact down a little from the previous quarter) and our forecast is that that’s where it’s likely to stay for the next few quarters. By comparison, the average annual GDP growth rate since 1960 has been 3.5%.

First the good news. Export volumes, mostly of minerals, are growing. World growth has bottomed, and in particular, China’s growth rate is starting to pick up. China is our largest market and is the world’s largest consumer of raw materials. Unlike last year, the federal budget has had a positive rather than a negative effect on consumer confidence. Consumer spending is picking up modestly, responding to lower interest rates and an increase in wealth, both housing and share markets. New housing construction is also rising.

Now for the bad news. Although consumer confidence is up a little since the budget, various measures of business confidence are falling sharply, pointing towards an ongoing reluctance by business to invest and hire. The small business tax write-offs introduced in the budget will help, but not enough. Mining fixed investment continues to decline, as projects reach completion. And although the volumes of minerals exports is strong, the prices received have fallen sharply over the last year. There are some signs that this process has ended, especially for iron ore. But prices are unlikely to rise to anywhere near the heights reached during the Chinese boom. In essence, the terms of trade (the prices we get for our exports relative to the prices we pay for our imports) rose considerably during the commodity boom and have a long way to fall before they reach the long-term average. Wages are increasing at the lowest rate in 20 years. And the ratio of personal debt (including mortgages) to incomes is already high, which is likely to make consumers cautious about increasing spending.

Our judgement is that these forces balance each other out, so real growth will stay at between 2 and 2.5% for the next year. Though that is still a positive rate of growth, it won’t “feel” good, because wage growth will remain sluggish and the unemployment rate will continue to rise. Even if this is the bottom (and we suspect it isn’t), the recovery from here will be slow and grinding.