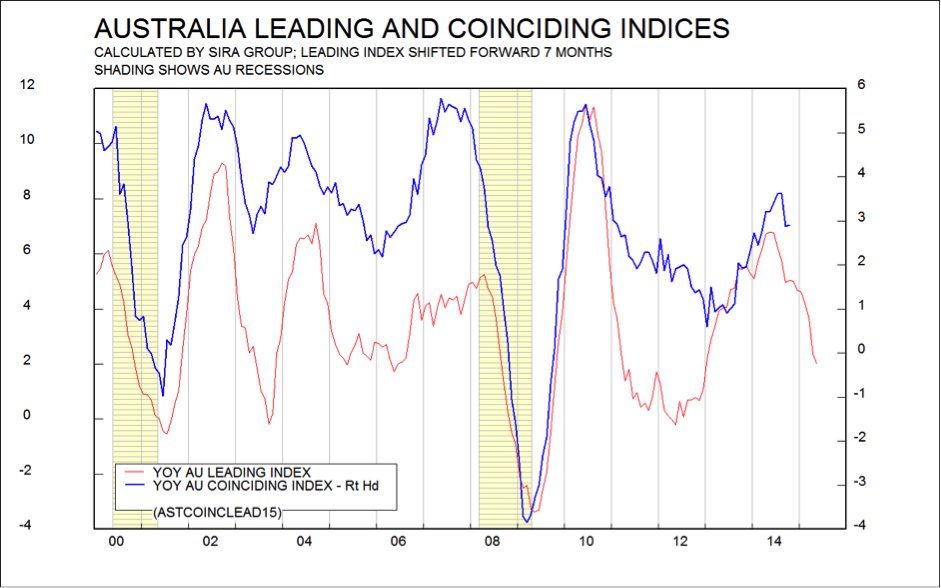

The SIRA Group Australian leading index, which is designed to give advance warning of impending shifts in the Australian business cycle, has been falling for nearly a year now. And over the last couple of months, our coinciding index has also begun to slide. The leading index is the red line in the chart below. Note that it has been shifted to the left by 7 months, which is approximately how long it “leads” the overall economy. You can read previous articles about these indicators here and here.

This isn’t very surprising:

- Although the US remains strong, Europe is weak, Chinese growth is normalising at a new lower level, and other major world economies are sluggish.

- So the prices of our major commodity exports (coal, iron ore, gold) are plumetting.

- Consumers are on strike. For political reasons, the government has chosen to emphasise the need for austerity, and this has worsened consumer confidence, which remains very fragile and has been sliding since the election. Wage increases are at record low rates, the unemployment rate is rising, and employment growth is below trend. The usual mechanism whereby falling interest rates, via rising house prices, leads to consumer spending increases has barely worked this time. Given how much interest rates have fallen, consumer spending should have boomed, and it hasn’t.

- Business confidence rebounded after the election but is falling again. Mining investment, which exploded between 2009 and 2012, is dropping as projects are completed.

- The only boom around now is in house prices, and then only in Melburne and Sydney (see this piece about housing). And this boom paradoxically means that the Reserve Bank (RBA) is very unwilling to cut the cash rate again.

- Partly because of this, the A$ remains too strong for current economic conditions.

The RBA is working on a partial solution, which is to try and restrain investment buying in the property market by reducing the maximum LVR (loan to valuation ratio) for investment properties as well as tweaking the capital ratios banks must maintain against mortgage lending. If this is successful, they will be able to cut the cash rate, which will help the A$ decline without triggering a runaway housing bubble. But this fix could be months away. The other solution would be fiscal, with the government cutting tax rates and stimulating spending, but this would be a major policy backflip and seems very unlikely.

The likely result of all these forces is below trend growth in Australia over the next year.