Will Australia enter a recession soon?

Will Australia enter a recession soon?

The answer in part depends on how you define a recession. The traditional (U.S.) definition has been two consecutive quarters of negative growth in real GDP (Gross Domestic Product). Real GDP is the volume of output in the economy, in other words, the level of goods and service produced after inflation is removed. For example, if inflation is 5% and nominal (unadjusted) GDP rises by 2%, real GDP has actually fallen—by 3%. On this definition, Australia has not entered a recession, nor will it. That doesn’t mean growth in real GDP won’t be below the long term average, which is 3.5% p.a. since 1960. It’s hard to remember that we managed to get a scintillating average growth rate of 5% per year during the sixties, with unemployment averaging just 1.5%.

For reasons which we have discussed before, it’s very likely that real GDP growth over the next couple of years will be 2% or less. But, technically, that’s not a recession, because growth will still be positive. Sometimes lower than average growth is called a “growth recession” and that is what we are experiencing now, and are likely to continue to experience over the next few years.

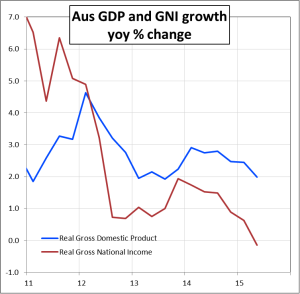

However, if you look deeper than just the headline GDP numbers, it’s plausible to argue that we are in a recession. For example, real Gross National Income growth is negative. The difference between National Income and GDP, essentially, reflects the prices we receive for exports and the prices we pay for imports. Because of the decline in commodity prices, even though we are exporting more in volume terms, what we earn is down because prices are falling. In the chart, you can see how real National Income growth has steadily deteriorated from a situation where it exceeded real GDP (because commodity prices were high) to one where it is now way below real GDP. To put this another way: as a nation, we’re working just as hard or harder than before, but we’re being paid less. And as we all know, that situation tends not to feel that good!

However, if you look deeper than just the headline GDP numbers, it’s plausible to argue that we are in a recession. For example, real Gross National Income growth is negative. The difference between National Income and GDP, essentially, reflects the prices we receive for exports and the prices we pay for imports. Because of the decline in commodity prices, even though we are exporting more in volume terms, what we earn is down because prices are falling. In the chart, you can see how real National Income growth has steadily deteriorated from a situation where it exceeded real GDP (because commodity prices were high) to one where it is now way below real GDP. To put this another way: as a nation, we’re working just as hard or harder than before, but we’re being paid less. And as we all know, that situation tends not to feel that good!

So even though Australia is likely to avoid recession, as officially defined, it certainly won’t feel like a boom. Unemployment will continue to drift slowly higher, because although real GDP growth is positive, it’s not enough to absorb the rise in the labour force. Wage growth will remain very low, and national income and personal income growth will continue to stagnate. It will feel a lot like a recession.